News

Are you ready for Making Tax Digital?

30 Mar 2022

Are you ready for Making Tax Digital? Make sure you’re up to date with the new MTD rules beginning April 1, 2022.

- Are you ready for Making Tax Digital?

- What is Making Tax Digital (MTD)?

- Compulsory data to be stored digitally

- What do I need to use the Making Tax Digital service?

- How will Making Tax Digital affect me?

- Support for VAT tax returns

- Making Tax Digital extensions and concessions

- How to finance a business VAT bill?

Are you ready for Making Tax Digital?

Making Tax Digital for Value Added Tax — part of the UK government’s overall digitalisation of the tax system — becomes mandatory for all VAT registered businesses from April 1, 2022. The move toward Making Tax Digital should help business owners cut down on errors and reduce the time spent managing tax affairs.

What is Making Tax Digital (MTD)?

In 2020, the UK government published “Building a trusted, modern tax administration system”, which set out the vision of a UK tax system fit for the 21st century.

The idea was to improve resilience, effectiveness and support for all taxpayers, with the Making Tax Digital (MTD) initiative being is the first phase of a move towards creating a modern, digital tax service.

Joanna Rowland, HMRC’s Director General for Transformation, said:

“Making Tax Digital is fundamental to the delivery of a trusted and modern tax system, making it easier for businesses to get their tax right and supporting the UK to go digital.”

Launched initially in April 2019 for those with a taxable turnover above the VAT threshold (£85,000 per annum), in 2021 the government announced that Making Tax Digital (MTD) for Income Tax Self-Assessment would be rolled out within the year and coming into effect from April 2022.

What is corporate tax?Compulsory data to be stored digitally

Business name, address, and VAT registration number

VAT on business or property income

VAT accounting schemes used

VAT on goods and services the business supplies

VAT on goods and services received

VAT return adjustments

The supply time and supply value of everything bought and sold

Rate of VAT charged on all goods and services supplied

VAT on the sale price and the purchase price of goods and services if they’re reverse-charge transactions

Daily gross takings if a retail scheme gets used

Items where VAT returns are recoverable if the Flat Rate Scheme gets used

Total sales and VAT on sales if gold gets traded under the Gold Accounting Scheme

What do I need to use the Making Tax Digital service?

Business email address.

You need to quote your Government Gateway user ID and password. You can create it when you use the service for the first time.

VAT registration number and your latest VAT return.

National Insurance number if a sole trader.

Company registration number plus Unique Taxpayer Reference if a limited company or registered society.

The Unique Taxpayer Reference and the postcode where you’re registered for Self Assessment if trading as a general partnership.

Unique Taxpayer Reference, postcode used for Self Assessment and the company’s registration number if you’re a limited partnership.

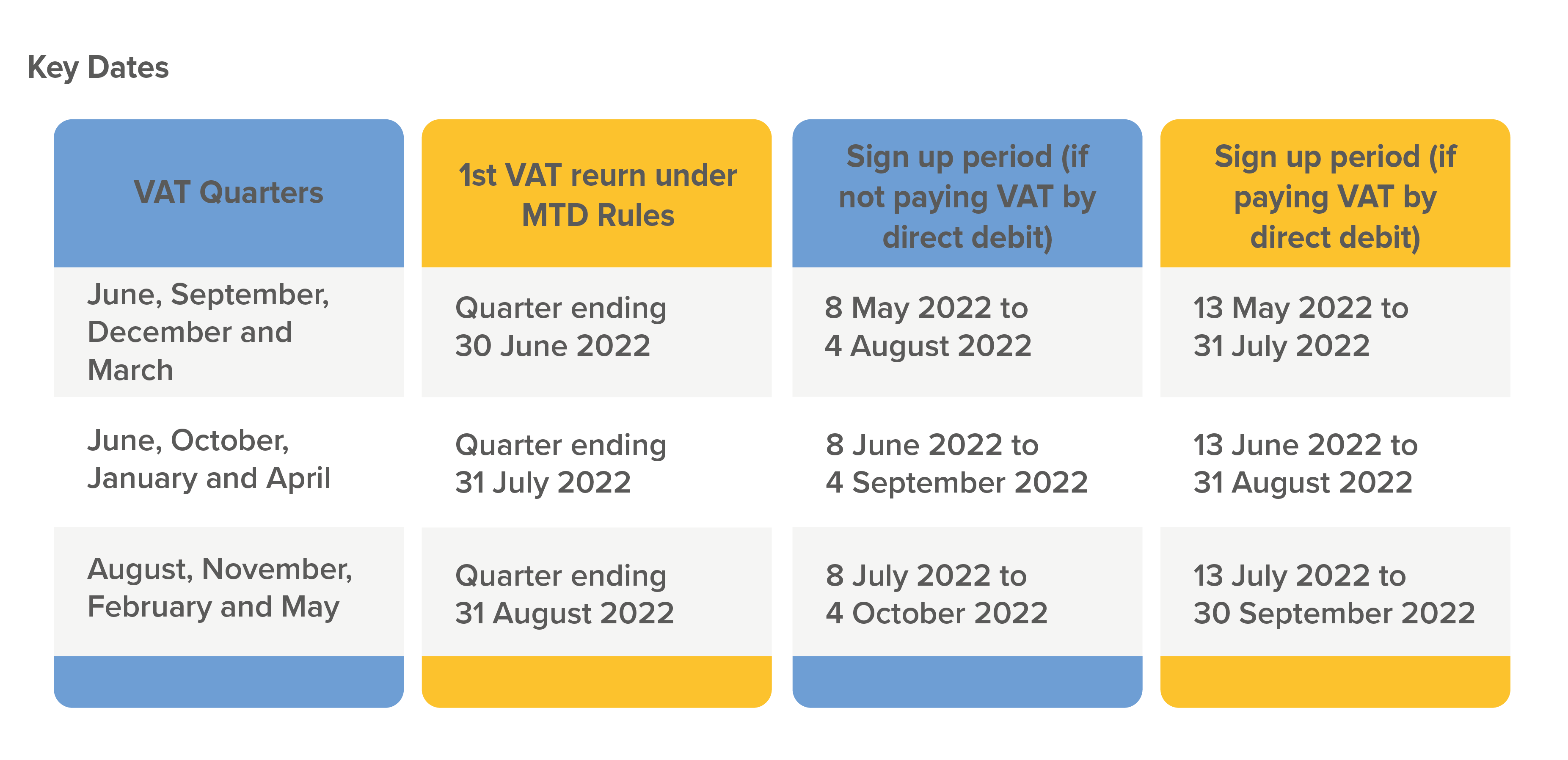

See the table below for key dates regarding the Making Tax Digital digital. As an added benefit, we’ve put together a list of important tax-related dates to keep in mind throughout the year.

How will Making Tax Digital affect me?

All VAT-registered individuals, charities or businesses with a taxable turnover above the VAT registration threshold of £85,000 must comply with Making Tax Digital changes from April 2022. They must, by law, maintain digital records and use compatible accounting software to submit their VAT returns.

The MTD service is, however, voluntary if the taxable turnover is below the VAT threshold. From April 2022, all applicable VAT returns must be completed and submitted using MTD bridging software or any other tax digital software compatible with HMRC systems.

Support for VAT tax returns

HMRC is committed to working with the government and its support services to minimise the costs and administration impacts of Making Tax Digital on small businesses.

Businesses can find help signing up for Making Tax Digital on GOV.UK. Agents can sign up on behalf of an enterprise, although businesses still remain responsible for meeting their VAT obligations. Those who do not join may get charged a late penalty.

Some VAT-registered businesses could be eligible for exemption from Making Tax Digital if it’s not reasonable or practical to use digital tools for their tax. If a business has previously received an exemption for VAT online filing, this carries over. Information on applying for an exemption is available on GOV.UK.

Also of interest is the government's super-deduction tax break. The initiative encourages UK firms – including startups – to invest in assets that will enable them to grow as we emerge from the lockdown.

Making Tax Digital extensions and concessions

HMRC recognises circumstances that arise during the preparation of VAT returns where calculations are made without specialist accounting software. HMRC will make a concession here, allowing those without compatible software (such as sole traders or those operating small businesses) to provide figures from manual calculations for certain VAT schemes, such as the partial exemption and capital goods schemes.

The MTD links between software packages must be in place before the first entire VAT period after April 1, 2022, with HMRC offering extensions to the deadline for certain technical issues.

Anyone requiring an extension should apply to HMRC directly, detailing why the business cannot meet the April 1 deadline, and supplying the following information:

Quote the current accounting software digital maps, showing where the journey fails and why it’s unreasonable to export data digitally

Provide an action plan with IT confirmation and a timetable for resolving the issue before April 2022

Show controls are in place, revealing that manual data is free of errors

Note that HMRC have stated that cost will not be an acceptable reason for missing the deadline

How to finance a business VAT bill?

January and April are both times when a lot of bills come due as a business owner, and the taxman is coming down hard on firms who owe money to HMRC. However, are various finance options available for businesses finding it difficult to finance a tax or VAT bill.

Finance for VATBusiness Finance

Check your eligibility using our online form without affecting your credit score.

Apply hereSubscribe to our newsletter today

Sign up for the best of Funding Options sent straight to your inbox.